Airbnb Occupancy Rates

You’re not sure how often your Airbnb should be booked. In other words, you don’t know what your Airbnb occupancy rate should be. Out of

Your Airbnb expenses are interwoven with your own personal finances.

Quick story time. Many years back, we checked into a simple Airbnb situated on the second floor of a house just a few minutes walk from a historic main street running parallel to a beautiful river. The Airbnb’s location was our primary motivation to book the place. We knew the accommodations would be basic, but when we arrived and saw the one and only roll of toilet paper for our week-long stay, we got a little worried.

But minutes later, the host knocked on the front door. When we let her in, she was draped in plastic grocery bags from her shoulders to each wrist. She rummaged through each one, sifting through her own personal purchases as she looked for the amenities she’d bought for our stay: more toilet paper, hand soap, a backup shampoo in case we ran out, along with an assortment of snacks. She was kind, generous, and bubbly. As quickly as she’d arrived, she disappeared, and we went on to enjoy a delightful stay walking to the river each day.

But still, to this day, the thing I remember most from that stay was thinking, “Oh, that poor host! I bet she paid out of pocket for all of those things she gave us!” Sure, there’s a chance that she went home with the receipt and worked through it, line by line, to properly tease out and record the Airbnb expenses from her latest grocery store trip. But it seemed infinitely more likely that she didn’t. When your Airbnb expenses are completely interwoven with your own personal finances, the most likely outcome is paying too much in taxes because you never deducted all of your Airbnb expenses from your income first.

Separate your Airbnb’s finances into their own business accounts.

Every Airbnb host has different strengths. For some hosts, thinking of themselves as a business owner comes naturally. These folks tend to set up a separate bank account, credit card, and even an LLC for their newly formed short term rental operation from the get-go. These folks will glance at this post’s title asking if they properly track their Airbnb expenses and think, “Of course! What other way is there to do it?”

But for other hosts, Airbnb expenses are the last thing on their mind. Maybe it sounds intimidating. Maybe it sounds boring. Many of these hosts are standing at the starting line of their Airbnb adventure thinking, “Oh, the bookkeeping can wait. Who wants to do paperwork when there’s a brand new interior design to create!?”

Still other hosts hesitate for other reasons. Some folks are thinking, “Let’s see if anyone actually wants to book our spare bedroom before we set up a bunch of additional accounts that might be completely irrelevant in a month.”

Regardless of where you started, think about where you are today. If you’re reading this as an active Airbnb host, you need to treat your Airbnb operation as the business it is. And a foundational piece of the business puzzle is accurately tracking all of your Airbnb expenses and income.

While platforms like Airbnb make it pretty easy to know how much money you made this year, tracking expenses is completely up to you. And if your Airbnb expenses are interwoven with your own personal financial accounts, the most likely outcome is that you’re paying too much in taxes because you haven’t fully deducted all of your necessary Airbnb expenses before you tax your post-expense income.

Set up a checking account and credit card for your Airbnb business.

When tax time rolls around, the easiest way to ensure that you’ve correctly tracked all of your Airbnb expenses for the entire year is to start off the year with your financial ducks in a row. You just need the right systems in place, and the tracking will take care of itself. If all of the money related to your Airbnb goes in and out of stand alone accounts, then the year-end math is super simple and you end up keeping more of the income you earned.

So if you’ve already set up a separate checking account and credit card for your Airbnb business, bravo! But if you’ve been kicking that can down the road (or perhaps never even thought about it), consider this your tough love encouragement to go knock out this essential business step. We promise: you and your bank account will thank yourself the next time tax season inevitably returns.

You’re not sure how often your Airbnb should be booked. In other words, you don’t know what your Airbnb occupancy rate should be. Out of

Surrounded by Fourth of July flags and festivities, our latest post found its inspiration in an American staple: small businesses. Throughout our travels, we’ve been

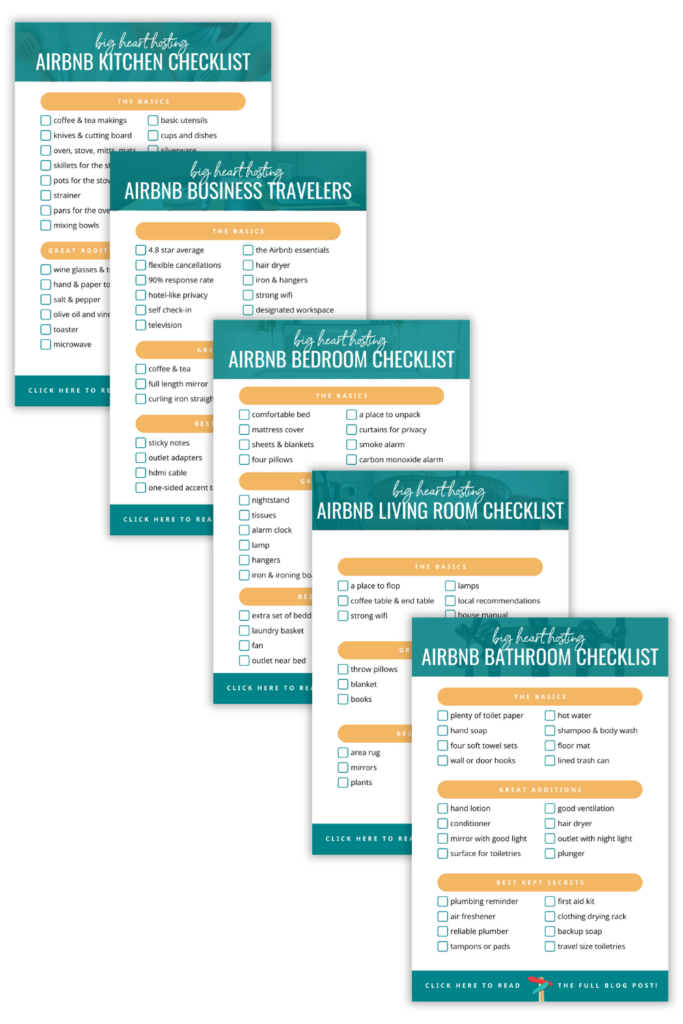

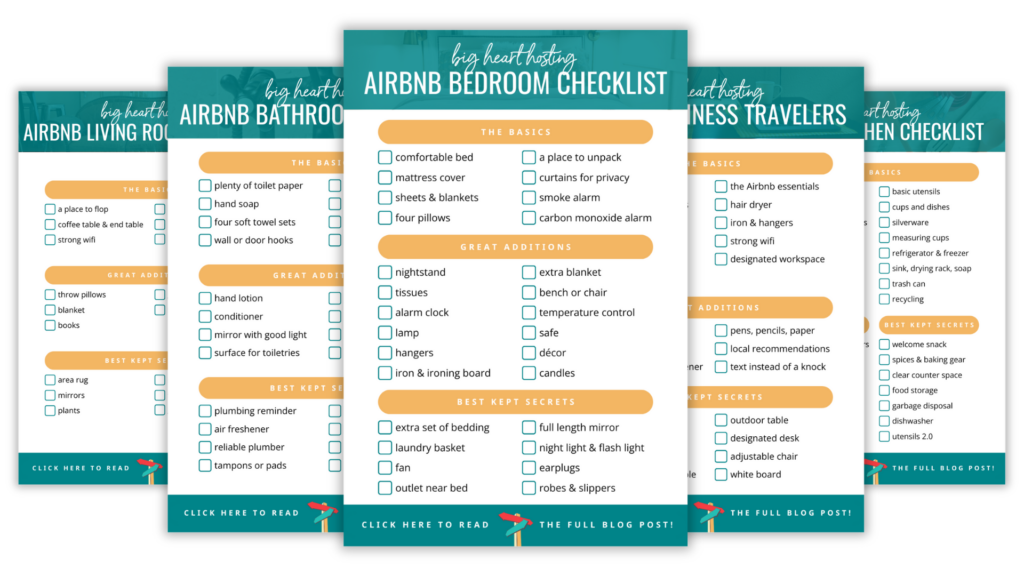

The number one question we hear from hosts is “What am I forgetting to put in my Airbnb?” This collection is the definitive answer to that question. In our signature product, we go room-by-room, step-by-step until your Airbnb is perfectly appointed and ready to impress. Bye-bye blindspots and hello happy guests!

free checklist!

Luckily all 15 of these common mistakes are super easy to fix. Grab your copy of the checklist below and dive on in!

You’re an ambitious Airbnb host with a big heart. But on some days, hosting isn’t exactly what you had imagined. Maybe it’s overwhelming. Or isolating. Or just not making the kind of money you had envisioned. At Big Heart Hosting, we’re on a mission to help hosts like you thrive, not just get by. We create step-by-step resources that bring together the best hosting strategies from around the world. We’ll give you the knowledge and community you need to create the joyful, prosperous Airbnb you deserve.

categories

Your Airbnb is a delight. And so were the handful of other Airbnbs you’ve visited. Sure, you could have given those hosts a few pointers,

Your Airbnb is loaded with thoughtful touches and generous hospitality. You really are the hostess with the mostest. Except…most of your kind gestures never get

At Big Heart Hosting, we’re on a mission to help hosts like you thrive, not just get by. We create step-by-step resources that bring together the best hosting strategies from around the world. We’ll give you the knowledge and community you need to create the joyful, prosperous Airbnb you deserve.

Privacy & Cookies: This site uses cookies to improve your experience. By continuing to use this website, you agree to their use. See our Privacy Policy to find out more, including how to control cookies.

Hello! We’re honored to be a small part of your hosting adventure. We truly love connecting with hosts one-on-one. Send us a message here, and share what you’re creating. We can’t wait to celebrate with you!

Copyright © bnbNomad, LLC. All Rights Reserved

Download our most popular free hosting resource now!

THE AIRBNB BEGINNER CHECKLIST BUNDLE

Download our most popular free resource now!